- #Cost of quickbooks payroll full#

- #Cost of quickbooks payroll software#

- #Cost of quickbooks payroll trial#

- #Cost of quickbooks payroll mac#

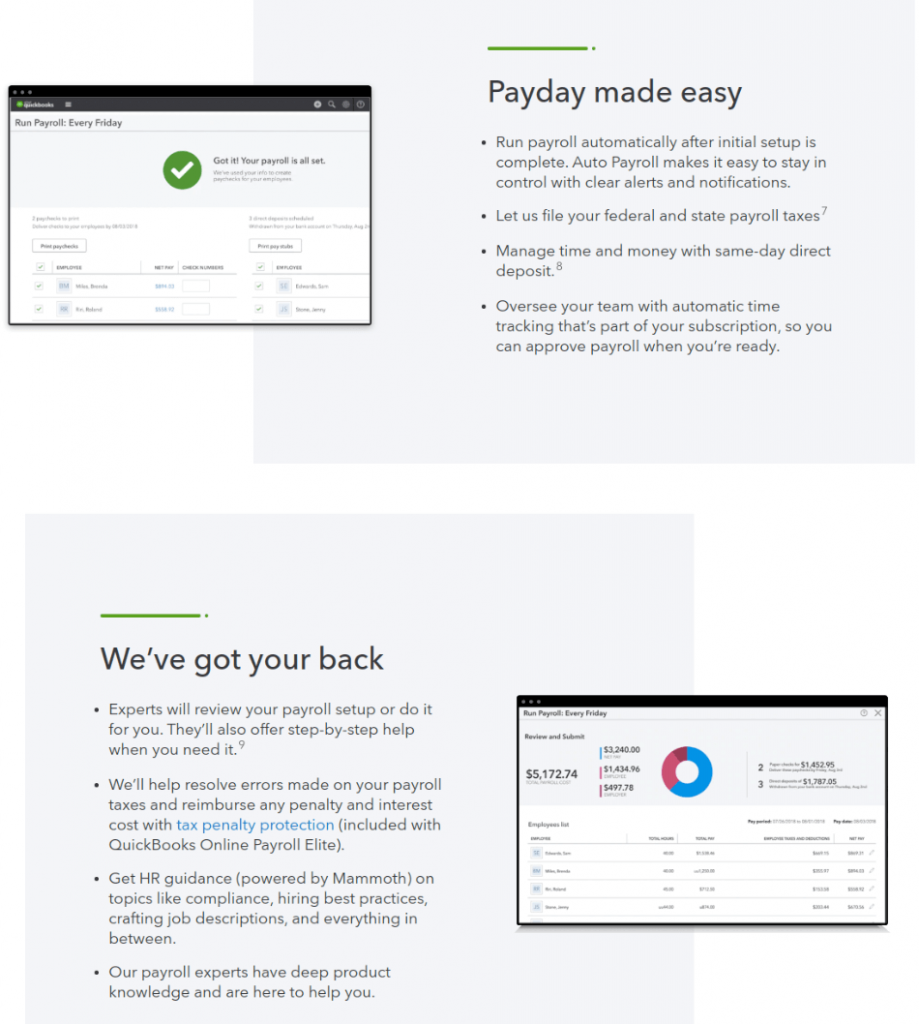

They provide callback support and answer your queries.ġ099 E-file & Pay: Through this, you have the option of e-file 1099 MISC and 1099 NEC forms. You can call anytime or can request to get a call. It gives alerts about the scheduled clock-in and clock-out and gives notifications to managers if employees don’t clock in and clock out as scheduled.Ģ4×7 Customer Assistance: Quickbooks team never let you down if you’ll confront with any issue. It also helps in managing the employee timesheet which helps in scheduling the employee’s shift, job, and task. Time Tracking: This feature helps you to manage people and their project to know who’s working on what project with a job description that what they are doing. You just need to enter the hours of each employee, sick time, and vacation pay and set the schedule for payroll and run and the rest work will be done by QuickBooks automatically.Ĭalculate tax: In QuickBooks payroll, you will get the details of all your taxes which are calculated automatically, and also pay the payroll taxes for you.Īuto Payroll: This is an additional feature in which you have to just set the payroll in automatic mode through this payments of employee is calculated by QuickBooks automatically with all types of deductions.

Same-day direct deposit: With the help of this feature, you can pay money to your employees on the same day with direct deposit without any extra cost. They directly deal with the IRS, you do not need to do anything that gives you peace of mind. Tax penalty protection: If you’ll receive any tax mistakenly either state, federal, or local payroll tax penalty then it will be resolved by Intuit team’s experts and help in reimbursing the penalty. In the year 2023, you’ll get some additional features of QuickBooks payroll that can help your business to grow. Features of QuickBooks Payroll that make your business stand out

#Cost of quickbooks payroll software#

That means you’ll have a chance to take a test drive of the payroll software before you can actually go for it.

#Cost of quickbooks payroll trial#

Below you can find the breakdown of all the services available like price and feature, after that, you can easily decide which payroll service will be going to perfect for your business.Īll the customers that are going to use QuickBooks payroll for the first time are eligible for 30 days trial on all the plans. There are many versions of QuickBooks payroll like QuickBooks Online Self-service Payroll, QuickBooks Online Full-service Payroll, QuickBooks Online Payroll, and QuickBook Desktop Payroll that has different plans, pricing, and features.

It can integrate with other accounting software, although it does not possess all the features the other high-end payroll service software this is what makes Intuit QB Payroll easy to use and navigate for small businesses and self-employed persons.

#Cost of quickbooks payroll mac#

#Cost of quickbooks payroll full#

QuickBooks Desktop Full Service Assisted Payroll.Features of QuickBooks Payroll that make your business stand out.Different Intuit QuickBooks Payroll Plans.As we all know many small businesses use QuickBooks as their account management system and with an integrated payroll service, it becomes easier to track and transfer data between both software. One of the best features of this payroll service is it can easily integrate with QuickBooks accounting software. In this, Intuit QuickBooks Payroll review article, we’ll show you the pricing and features that different QB Payroll offers. It not only helps in paying the employees but also takes care of the payroll taxes and year-end taxes as well. Intuit QuickBooks Payroll service is undoubtedly one of the best payroll services available for small and medium-sized businesses. Still, having an issue contact our QuickBooks ProAdvisor toll-free: +1-84 In this article, we’ve tried to compare and review different Intuit QuickBooks Payroll services, and then after doing extensive research and analysis we’ve found out which version would be a perfect fit for your business. Go through the article, here you will find different QuickBooks payroll plans and their overview, pricing, and detailed features of the plan.

Here, the article describes the details of payroll services. Want to know QuickBooks payroll plan pricing & support, then you are at the result page of your query.

0 kommentar(er)

0 kommentar(er)